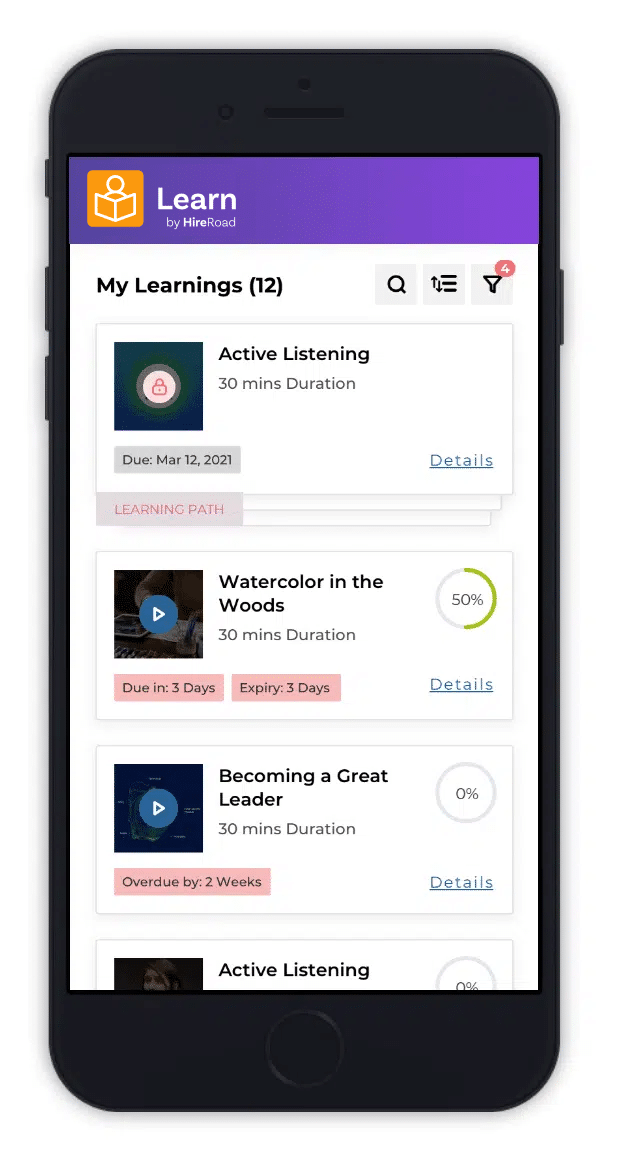

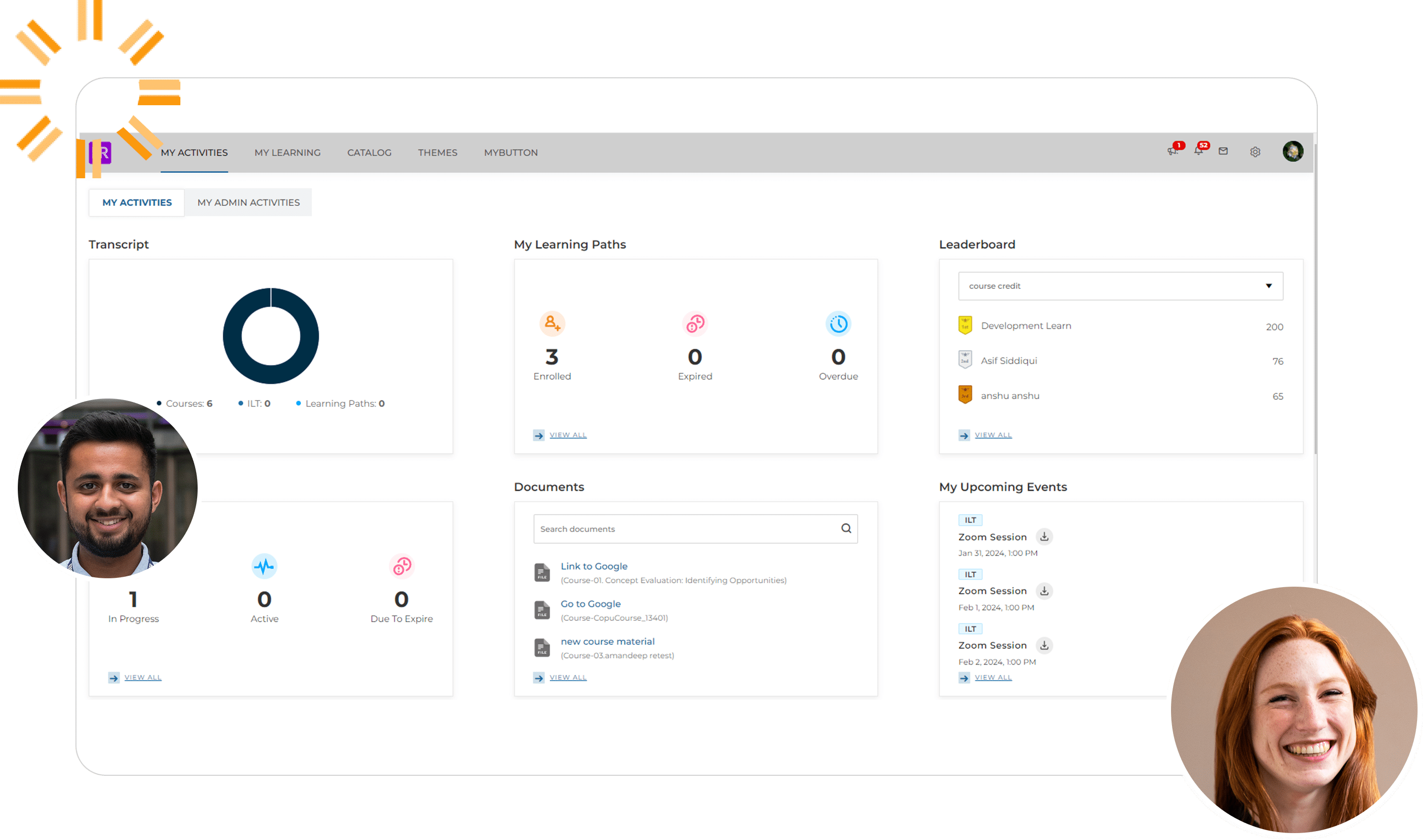

The Intuitive LMS for High-Performance Teams

Engage your team with on-brand, customized training. The HireRoad LMS helps you deliver A+ employee education at scale.

Build a more agile, high-performing workforce

| Make employee education accessible and impactful. Engage your team as they develop and grow. | |

| Offer branded, customized instruction with hybrid, in-person, micro-learning, remote learning, or instructor-led training. | |

| Experience the benefits of an eLearning expert-built platform. Our LMS was developed by the best of the best. |

“This LMS has all the features and adaptability to accommodate our unique needs as if it were designed for our company. It’s easy to add new users…and assign courses.“

Jeremy H., Human Resources, Financial Services Company

Client Case Study: Generac

Fortune 1000 backup power generation products manufacturer streamlines global training program. Both compliance and product training scale with our LMS.

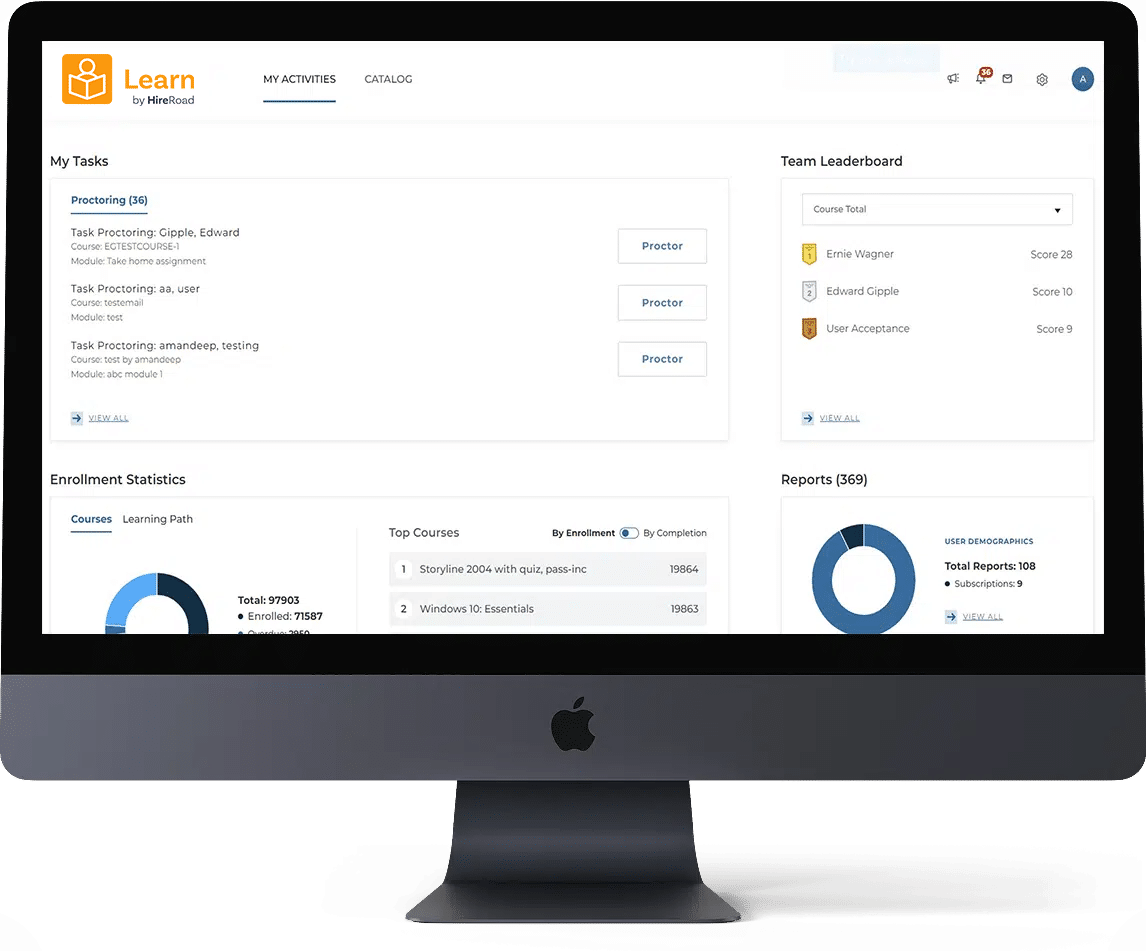

Automate compliance training and certifications

| Build compliance training into your onboarding process. Enroll users in an automated learning path. | |

| Create customized training paths based on each employee’s learning needs, role, and more. | |

| Create and manage employee learning goals, and track and report on their progress with ease. |